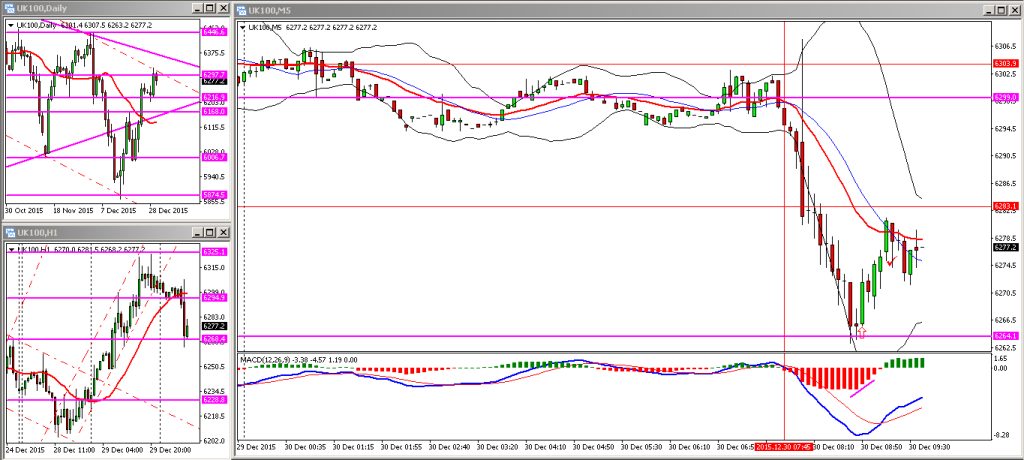

The FTSE traded in a very narrow range overnight, pretty much hugging the 6300 level, and it was only at the open that it declined sharply. Note the little spike up to clear overnight stops (typical turtle soup or stop raid pattern) prior to the drop.

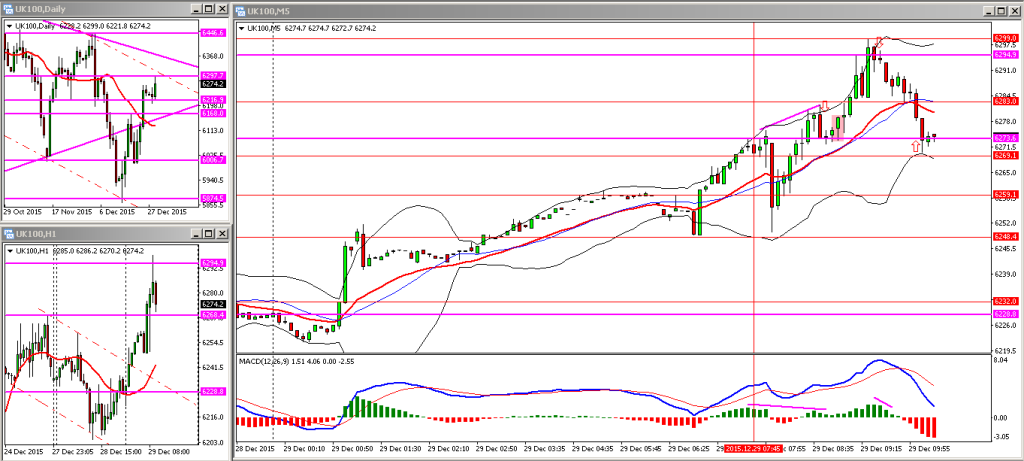

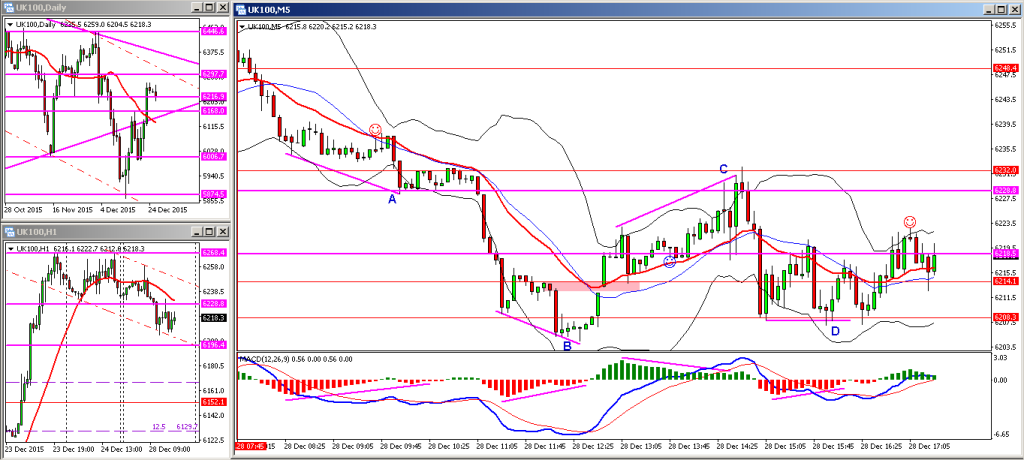

Looking at the higher timeframe charts I noticed that the FTSE was at the top of a declining channel which technically, may have explained the drop away from 6300. I only managed one trade which was off the previous day support at around 6265 and closed that out for 8 points.