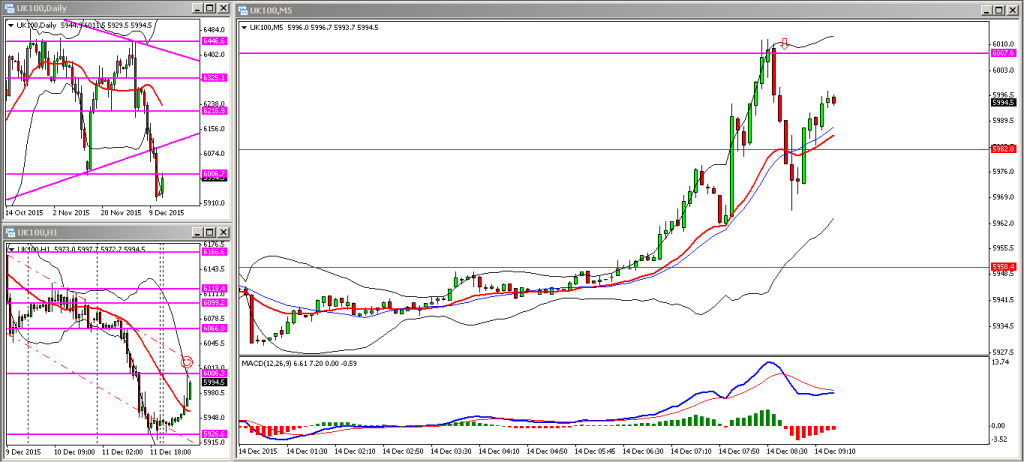

The FTSE had fallen for 5 consecutive days so although the markets looked very bearish this morning, I was wary that we could be oversold and that a bounce was due. However, Friday was a strong downward trend day, so my initial plan this morning was to look for any pullbacks to resistance and to get short which is exactly how it panned out. I got in at 6007 and closed out for 20 points as shown below.

Part of my reason for setting up this blog was to be able to reflect back on my trading periodically and to see the good, the bad and the ugly aspects of it. A chance for me to take a good look at myself in the mirror and judge how well I performed at the end of the day. Obviously the aim here is to analyse the various elements of my game and improve over time, a kaizen approach to trading.

There were some good points to take away from this weeks performance. First of all I was profitable and end up with a healthy collection of points, although in hindsight there were plenty of points left on the table. My overall read of the market was generally good throughout the week and analysing how things were developing on the higher timeframes was very helpful.

On the negative side, I still made some classic mistakes such as trading against the trend, trying to catch falling knives, and not letting my winners run. I was disappointed on trailing in my stop too quickly on Friday and as a result, missing out on the huge move down through the 6000 level despite getting the directional premise right and getting short in the morning.

Additionally I missed some trades during the course of the week as a result of not being able to sit in front of my charts all day (I still work at my J-O-B during the day). My trade selection was average, and unfortunately I also missed some setups which I normally would have taken had I been there in the first place, or had I been a bit more aggressive and followed up on my original daily premise.

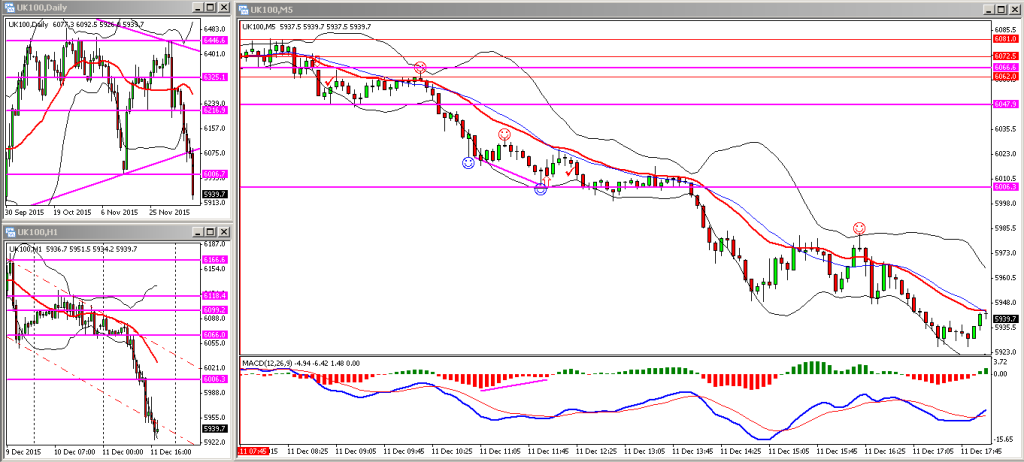

Unfortunately I was out this afternoon and missed the carnage during the US session. Only one other trade to report which was taken based on a class-A divergence pattern on the MACD histogram. It was a counter-trend scalp and I was quick to grab a few points before lunch. Popped out for a rather long lunch and when I got back I was really surprised to see that the FTSE 100 had crashed through the 6000 level as it had.

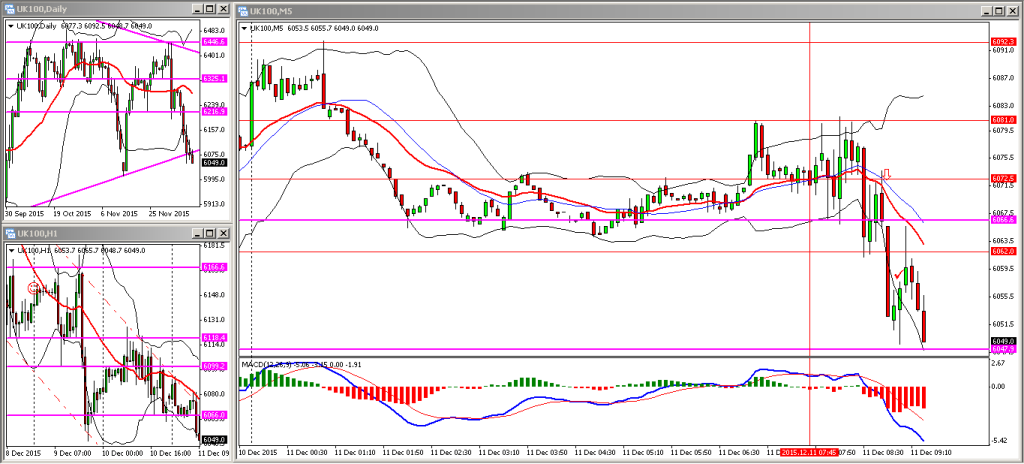

Key points to note going into this mornings session:

- On the daily chart the FTSE had broken through the lower trendline indicating a clear break in structure

- On the hourly chart the FTSE was at the top of the downward sloping channel

Given the factors above I was keen to short any pullbacks this morning…

I went short at the overnight resistance level of 6072 which also coincided with a pullback to the 20EMA, trailed my stop as the market fell, then got stopped out as it pushed up. Points in the bank and a good trade to reflect on; may not trade at all for the rest of the day unless I see a cracking setup present itself.