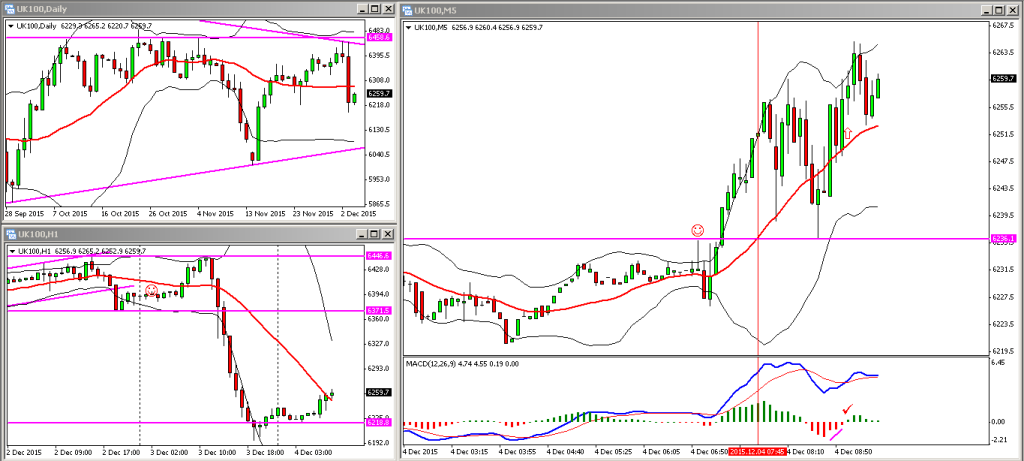

The market remained in positive territory till it promptly sold off around 1:45pm and eventually fell back to the intraday support level around the 6420 level. I managed to get long again off a MACD divergence pattern, coupled with the fact that price was testing the support level for the third time (triple bottom).

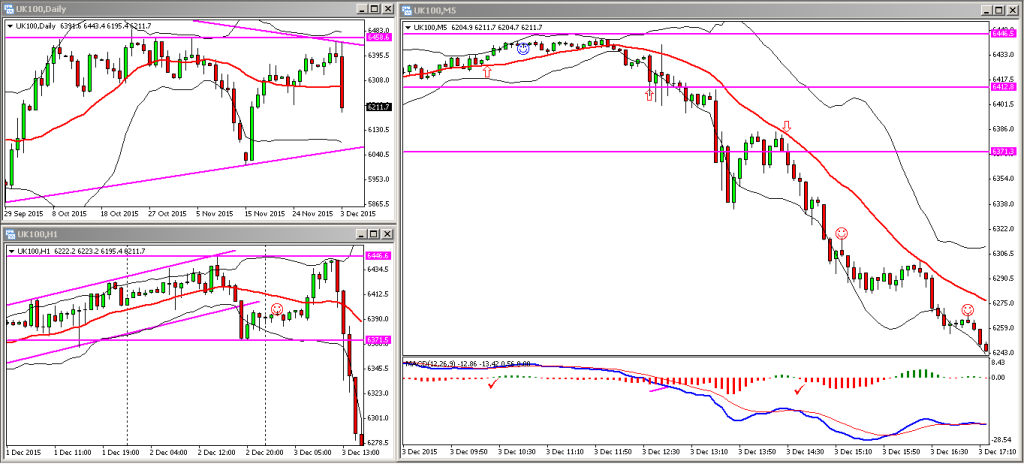

After the sell off yesterday, my plan was to look for any continuation patterns and short any pullbacks to the previous days highs, lows or support and resistance levels. Don Miller trades this way on what he calls MATD (morning after trend day) and I had that very much in mind before the open.

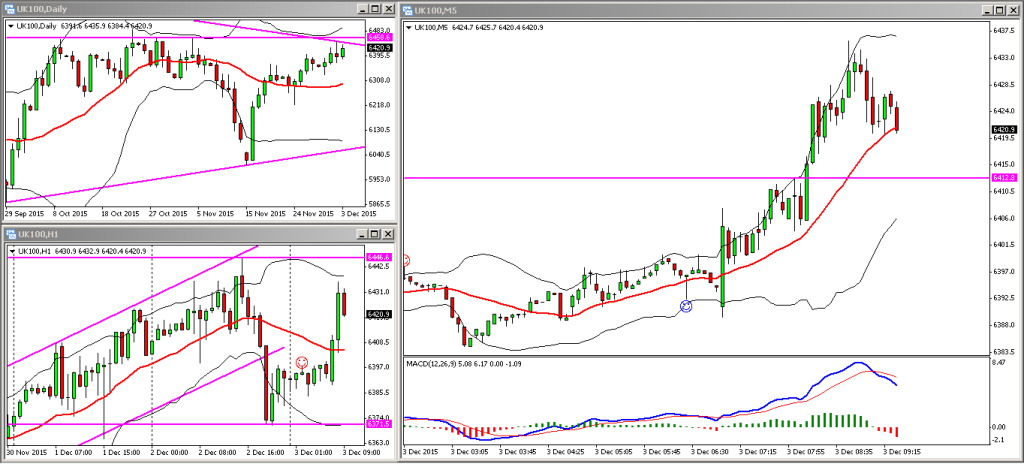

Managed to stay out of the market most of the morning and then saw a textbook setup – pullback to the 20 MA and at the same time the MACD histogram bars were decreasing and looking to go from red to green. Instead of going short I’ve gone long looking for the market to continue upwards till lunchtime, or when the US markets open.

Well the market rarely does what you think it will do and this afternoon was a good example. There was the ECB announcement this afternoon followed by a speech by the Fed in the afternoon. The result was a bit of a carnage in the afternoon with the markets selling off (due to a fear of interest rates going up).

I’m a price action trader so the news or fundamentals don’t really matter to me. What does matter is how price behaved after the news and how best to trade it.

When news has this kind of effect on the markets, the best thing to do is get on board the train! Look for potential pullbacks to key support / resistance levels, or pullbacks to the moving average as shown in the chart below.