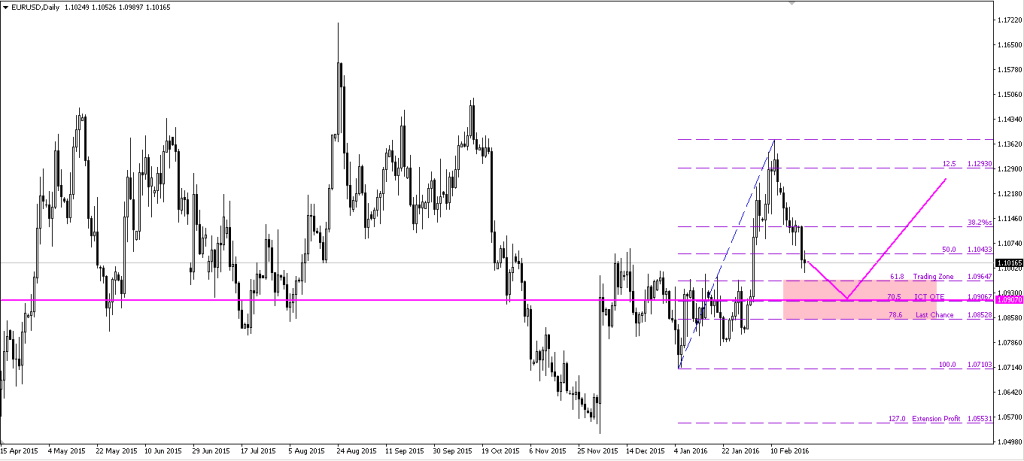

Placed a few ICT Sniper style trades off higher time frame charts but unfortunately with mixed results – a few losers and a couple of wins which helped balance the books. The idea behind this kind of setup is to wait for a pullback following a break in market structure, and to identify key level to trade off using the ICT 70.5% Fibonacci level.

I’ve traded this way before, identifying levels and placing set and forget style limit orders in the evening, then in the morning, checking to see if trades were triggered and if not, re-evaluating the setup and re-adjusting if required. Unfortunately results have not been great so far and I’ve decided to add some additional elements to improve the basic concept.