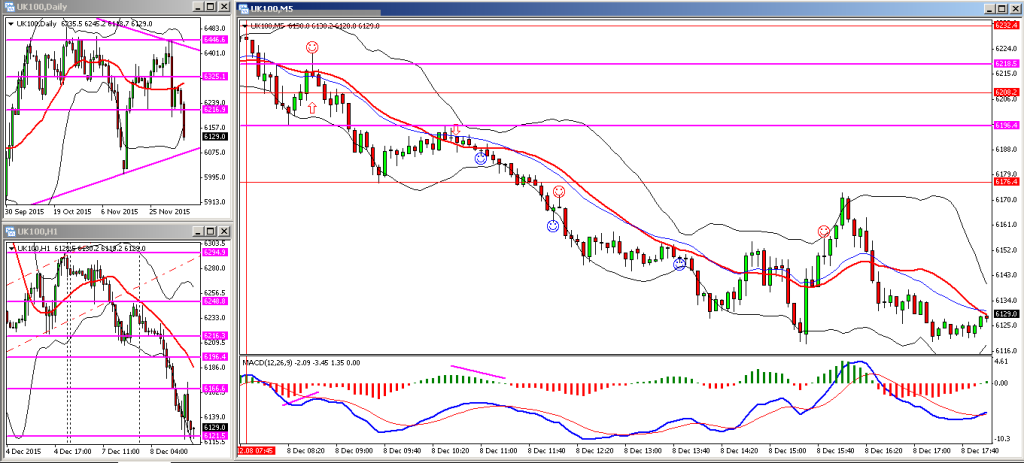

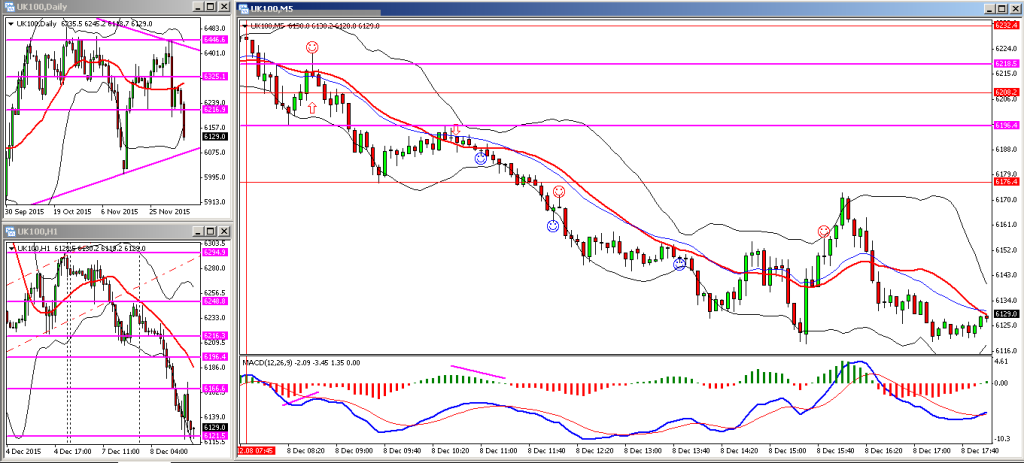

The FTSE behaved somewhat similar to yesterday in that it sold off from late morning onwards. Having missed out yesterday I was keen to get on the right side of the market and shorted the FTSE as it came back up to retest the previous support level at 6196. At the same time, the MACD histogram looked like it was starting to run out of steam and a doji candle had formed on the 5 minute chart. I closed out half the position at 6175 and left the remainder to run to 6165 (closed the position after the bullish pin-bar formed).

By the time the markets opened in the US the FTSE was heading back up and I didn’t manage to place any further trades – the FTSE did seem to be oversold at the time, especially on the hourly chart. There was also a lot of air on my charts and no clear support or resistance levels on the higher timeframes, so I decided to stay out of the market for the rest of the afternoon.