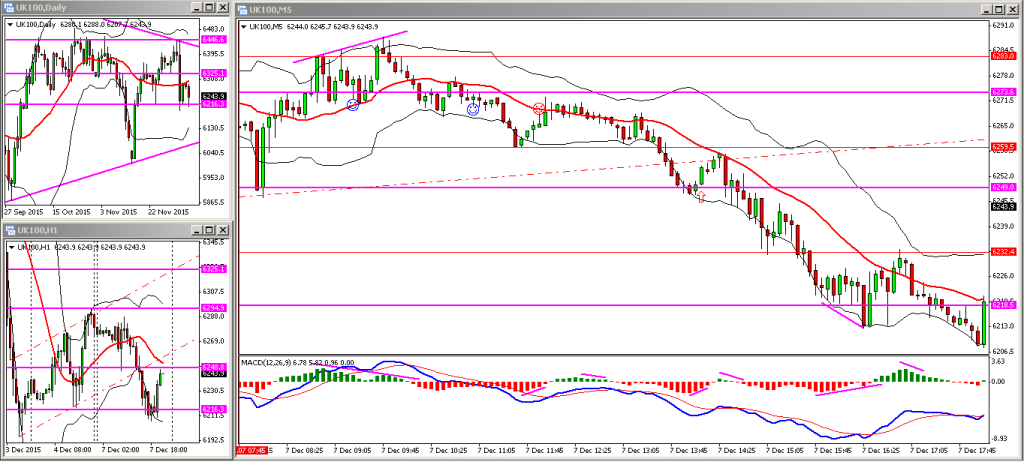

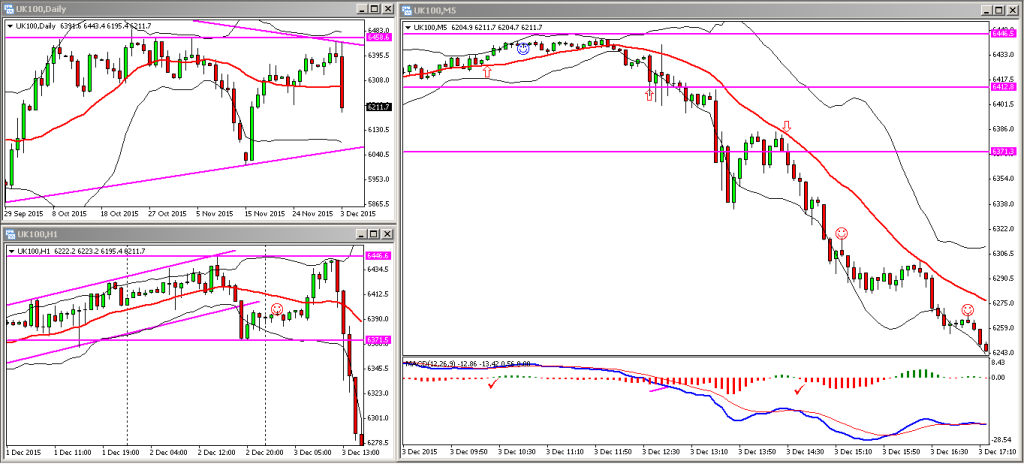

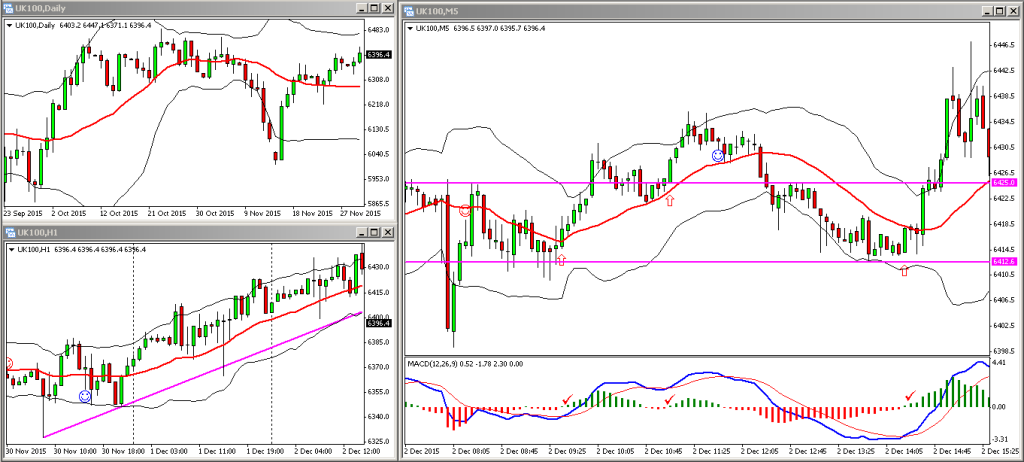

Quick round up of todays action with the help of the updated chart below. The FTSE traded within the range anticipated for most of the morning, then sold off in the afternoon and broke though the support level at 6249. I took a small long as price hit the support level and managed to scalp a few points.

In hindsight I should have traded off the MACD divergence signal and switched my bias – apart from the early rise this morning the market has been trading under the 20 SMA (simple moving average) and I would have done better getting short this afternoon.

On the daily and hourly charts the break in market structure is quite clear, so I’m expecting further weakness for the rest of the week.