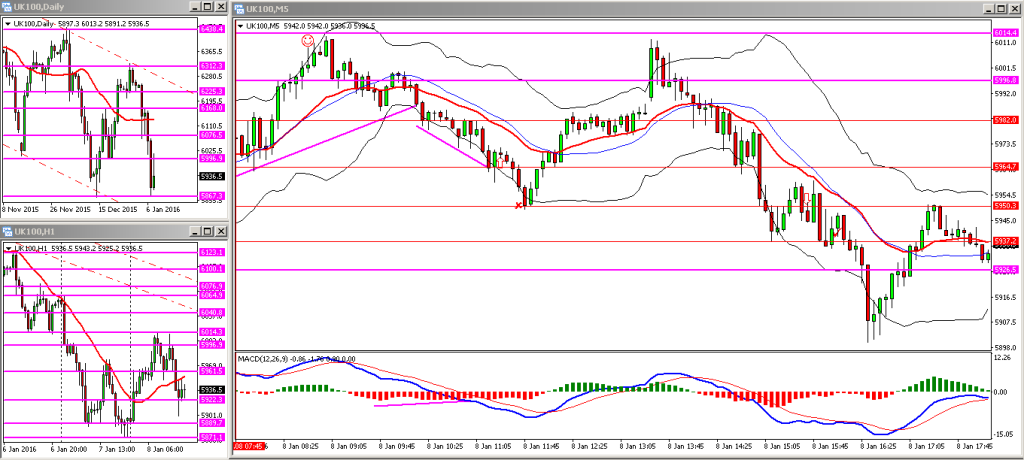

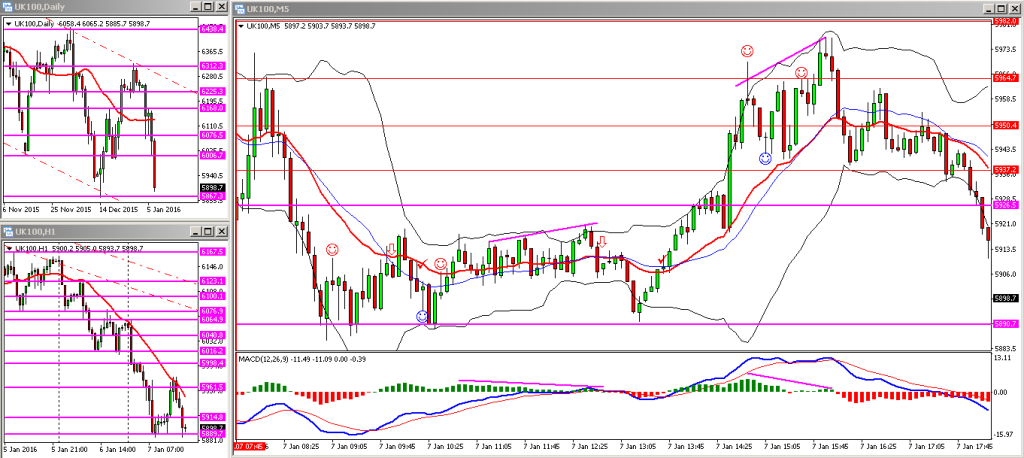

Bit of an up and down day with the FTSE trading between 6010 and 5950 for most of the day. I managed to place a couple of trades off intraday support and resistance levels – the first with MACD divergence which was a loss (stopped out for 20pts), and the second, an inter-changing SR play, which netted a few points. Unfortunately I missed shorting the double top formation although I mentioned the 6014 level in my update this morning,

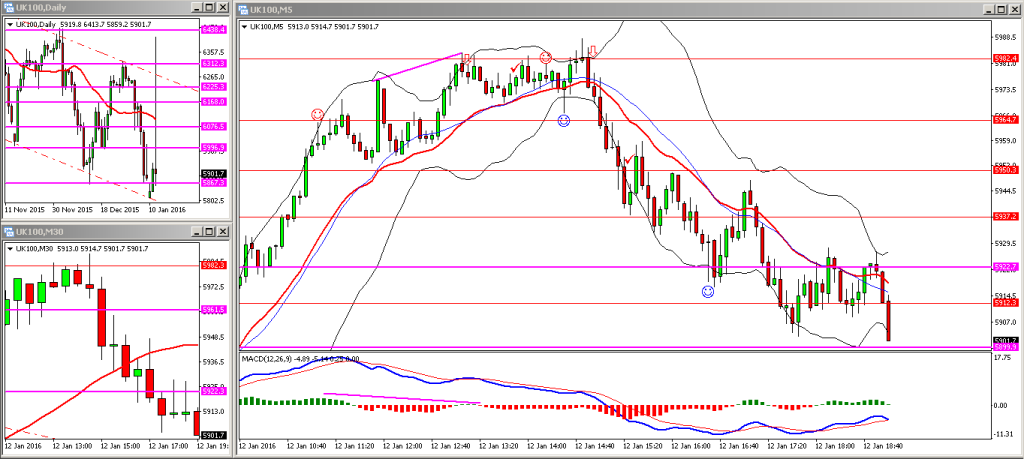

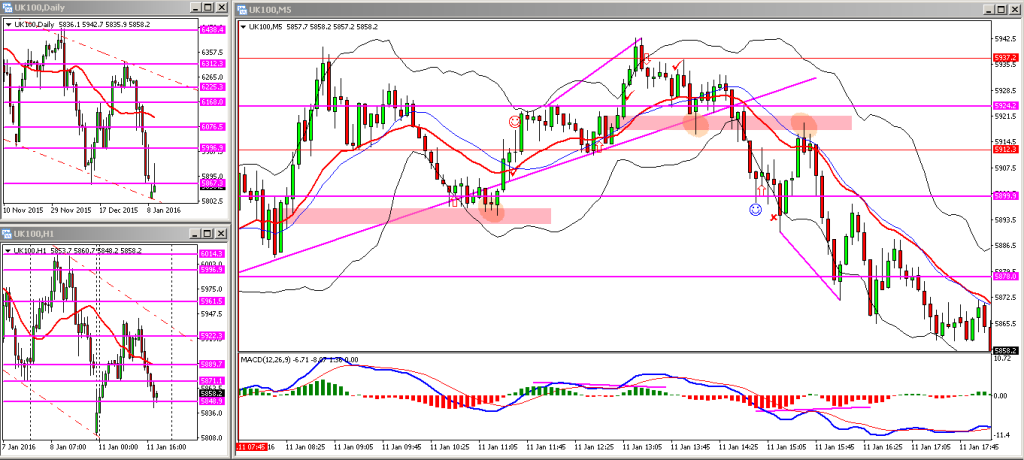

The FTSE was stuck in a narrow range for the rest of the morning session and only broke out to the upside as the US markets opened. I managed to get in a couple of shorts, the first was trading a pullback to the moving average which went against me initially and I closed out relatively quickly thinking the market would rally back up. The second was off a weak MACD divergence pattern, which I should have closed out sooner; instead I held on too long expecting the 20EMA to offer further resistance and unfortunately it didn’t.