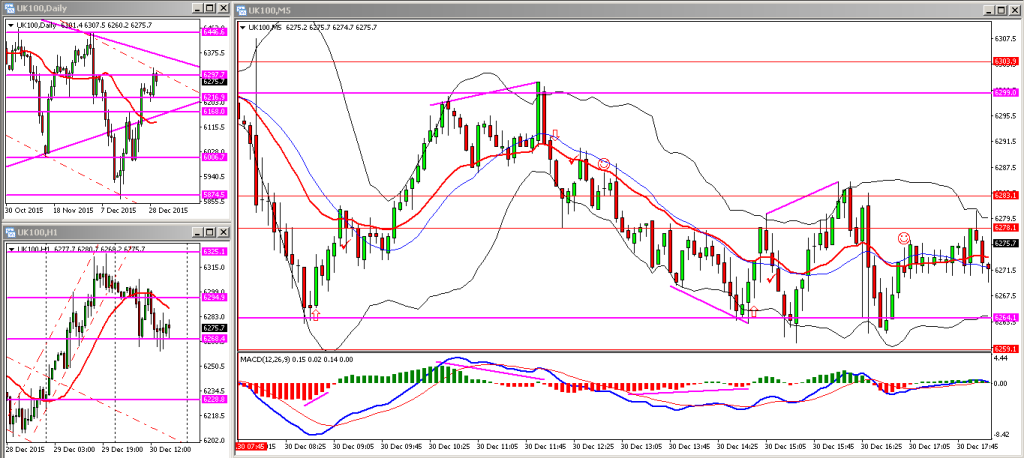

Despite the bullish sentiment as the end of year fast approaches, the FTSE failed to break through the 6300 level and remained confined by the downward sloping channel indicated on the daily chart. Two more trades for me after this morning’s trade, both off MACD divergence patterns plus key support and resistance levels.

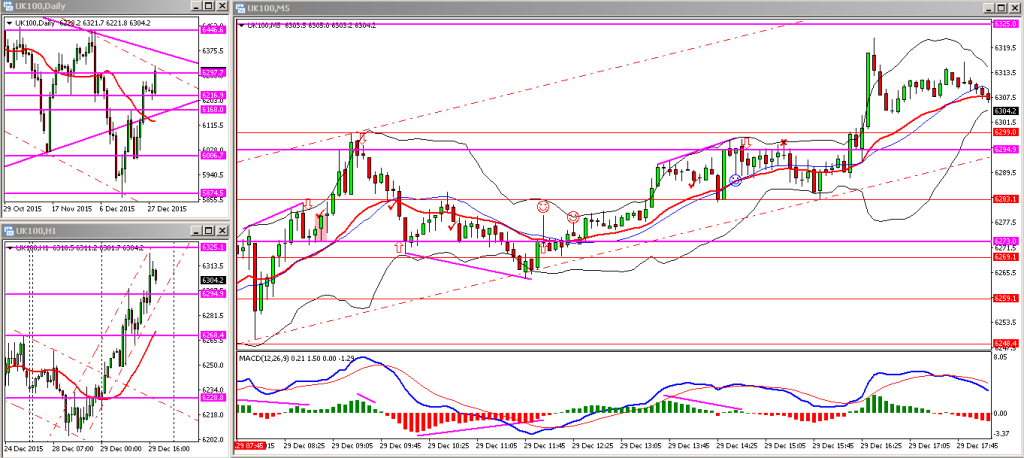

The FTSE 100 index traded in an upward sloping channel which slowly pushed lifted it past the 6300 level late this afternoon. After closing out the third trade from this morning for a handful of points, I placed two more trades which were both based on MACD divergence setups. The first was closed out for a healthy profit and the second, a counter-trend trade, was closed out for a small loss.

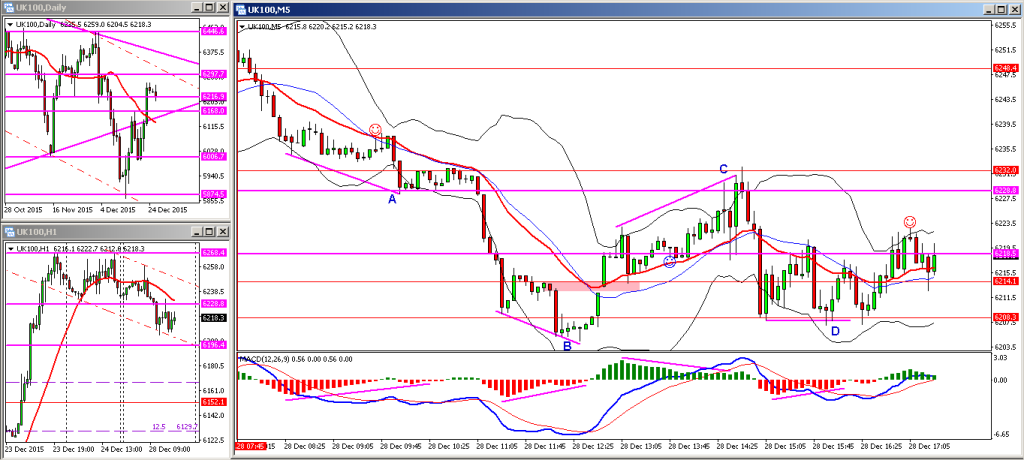

It was one of those days where you would have been profitable just trading the divergence between price and the MACD histogram bars. The first trade would have been a loss or possibly a scratch trade if you played it tight, with the other three trades ending up as winners in my book. Note that A, B & C were class-A divergence patterns, and D a class-B setup, as indicated on the chart below.