Its been a very volatile week with the FTSE being dragged down with the global sell off following the huge falls in Chinese stocks and currency. Unfortunately my performance has been a little hit and miss, especially towards the end of the week as I was a little anxious, expecting the market to rebound.

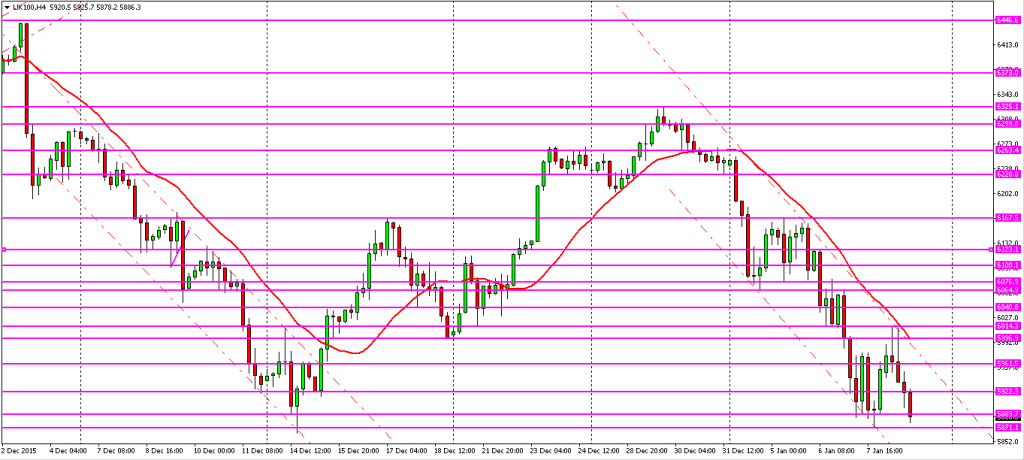

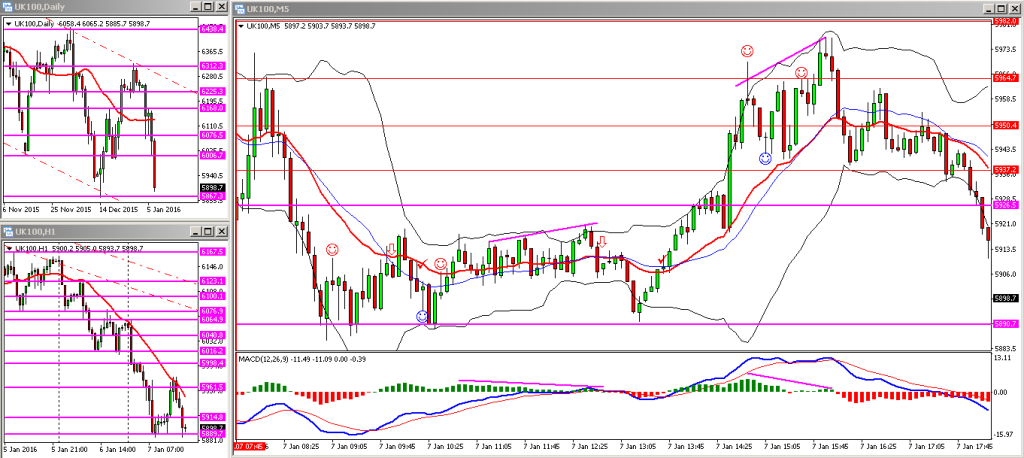

The 4 hour chart below shows the extent of the decline and also provides a look at the bigger picture:

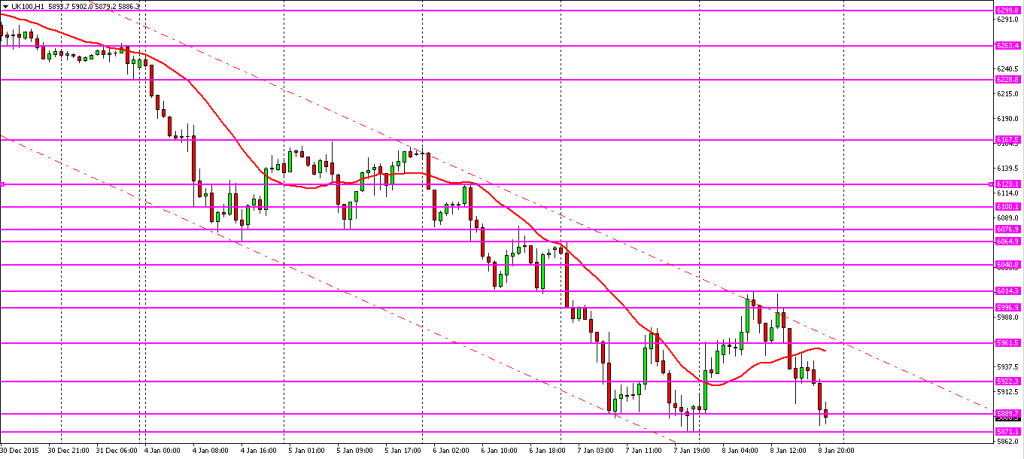

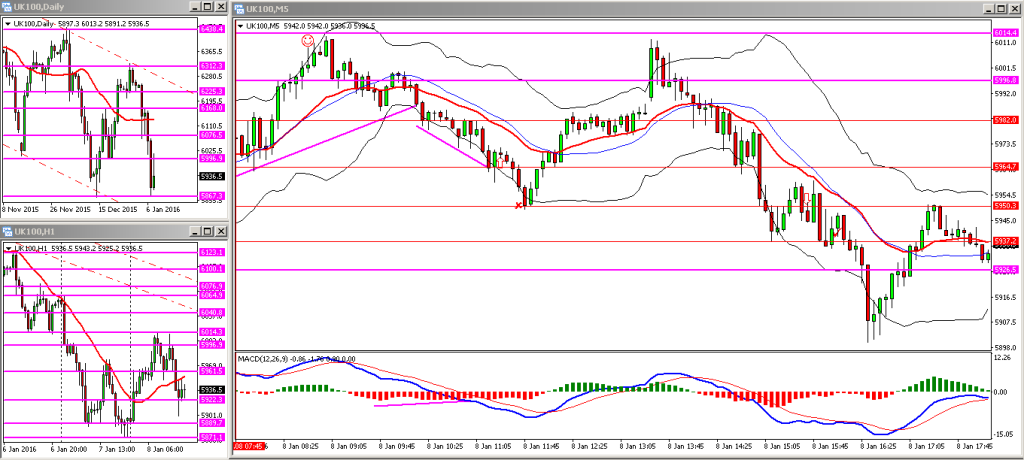

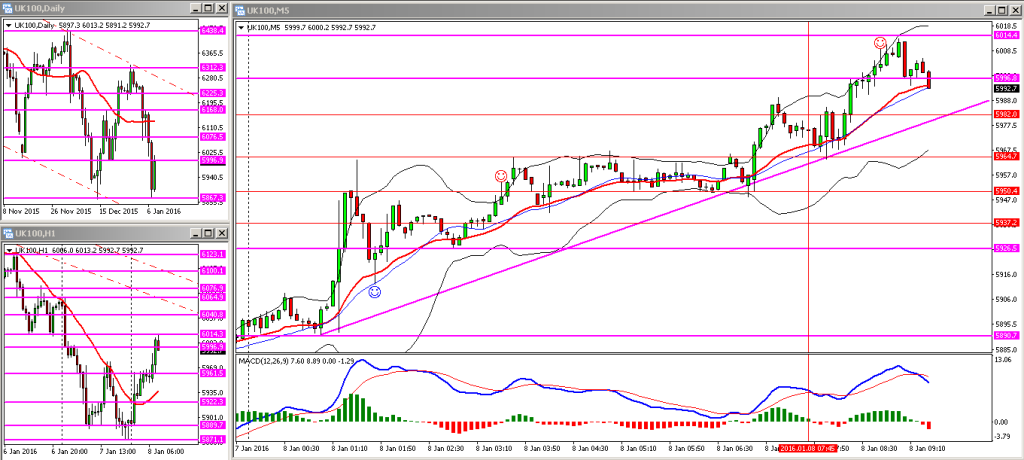

My intentions going into this week were to continue to trade with the trend, and that was the case at the start of the week. After reviewing my trades, however, it turns out that I placed a few risky counter trend trades which I may have done well to leave altogether. I also hesitated and missed taking positions off some key levels with the FTSE trading in the downward sloping channel as it was; case in point being that 6014 level on Friday.

We saw a recurring pattern with the FTSE this week (except for Friday) which was a sell off at the open, the market stabilising from about 11am till 1 to 2pm, recovering during the US session, and then finally selling off after market hours or overnight. Again, I failed to maximise my returns as I didn’t manage to exploit this recurring theme – I should have traded larger at the open and followed the initial direction of the market, and left the counter-trend trades for the afternoon session. Additionally, the trades that I did take with the trend were closed out for a profit, however, they could have netted larger returns had I held the trades longer till the end of the morning session.

On the positive side, I finished the week in the ‘blue’ again and managed to hold onto the gains from earlier in the week. Just kicking myself that I failed to really smash it … Still more room for improvement.