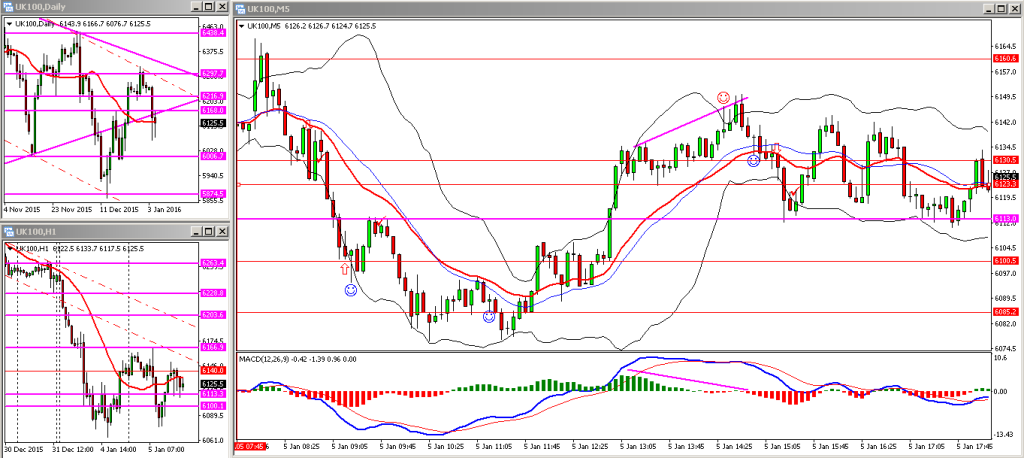

Further declines for the FTSE 100 index overnight saw it trading below the 6000 level again. Despite a slight retracement during the open, the market has pushed below further and is down at the 5900 level as I type this. Looking at the daily chart the FTSE is within the downward sloping channel and if it continues south, the FTSE could fall as far as 5770 before it hits the lower trendline of the channel. I’m itching to take a speculative long trade off this level but I think given the market direction over the last few days, it’s better to stick with shorts off any retracements. Looking to go short around the 5925 level and for previous support to become resistance.

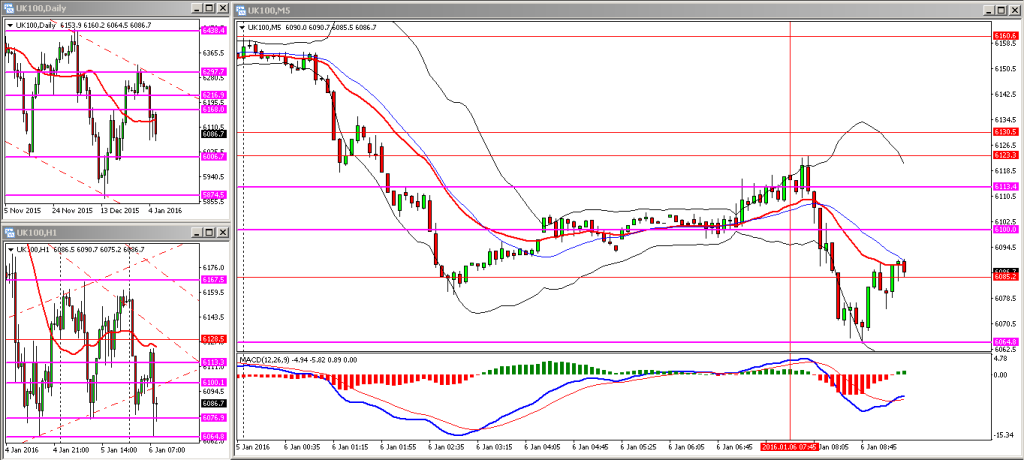

Well the market rarely does exactly what you anticipate it to do. The FTSE fell out of the trading range that I spoke about this morning, continued its decline and later managed to rally up during the afternoon session. The first trade this morning was counter-trend and based on divergence between price and the MACD histogram bars which I closed out for a loss (they don’t always work out). The second trade was better, trading with the higher time frame trend off another MACD divergence setup, and also looking for an interchanging support and resistance level to hold.

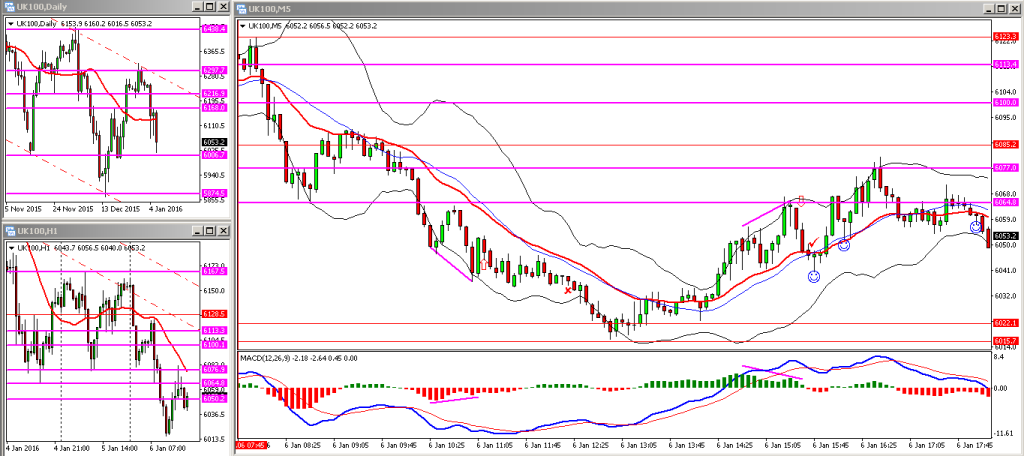

Overnight the FTSE sold off over 100 points then recovered a little prior to the open. At the open it was more downward pressure until it found support around the 6070 level. Looking at the hourly chart the FTSE is currently sitting in a trading range and I expect it to grind its way back to the top of that range by the close of play. One other possible scenario is a pullback to the 6100 – 6113 level and a sell off from there as support becomes resistance.

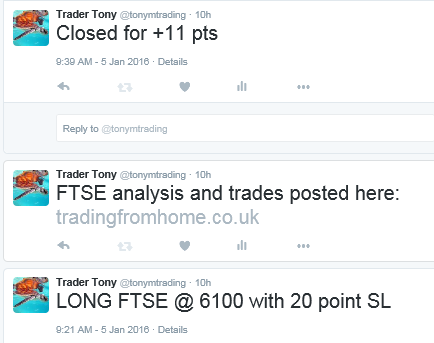

The FTSE struggled for the rest of the morning before running into support near yesterday’s lows, formed a double bottom and staged a small recovery over the afternoon session. I took 11 points from this mornings second trade (see the tweets below) and managed to grab another 10 points from a trade this afternoon after noticing the MACD divergence and entering once price had pushed past an intraday resistance level.