First of all I’d like to begin the year by wishing all of my readers a very successful, profitable and prosperous New Year! I hope you’ve enjoyed reading my blog and over the course of the year, I hope to make it an even better resource for both experienced and budding traders. Please feel free to contact me if there is any specific content that you would like me to share or provide, and I’ll endeavour to do my best to deliver.

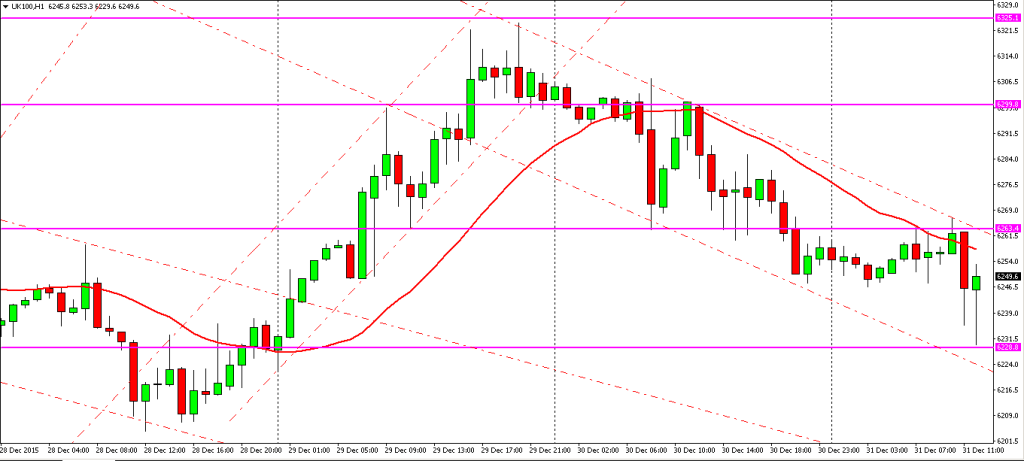

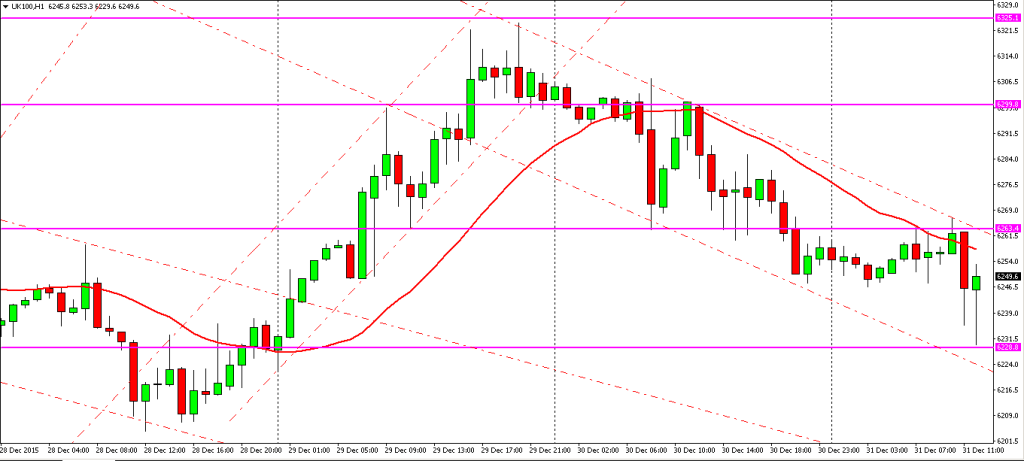

Now to business and a look at last weeks chart which shows the final stage of the end of year rally which managed to push the FTSE 100 index over the 6300 level, before selling off again along the downward sloping channel to close the year at approximately 6250.

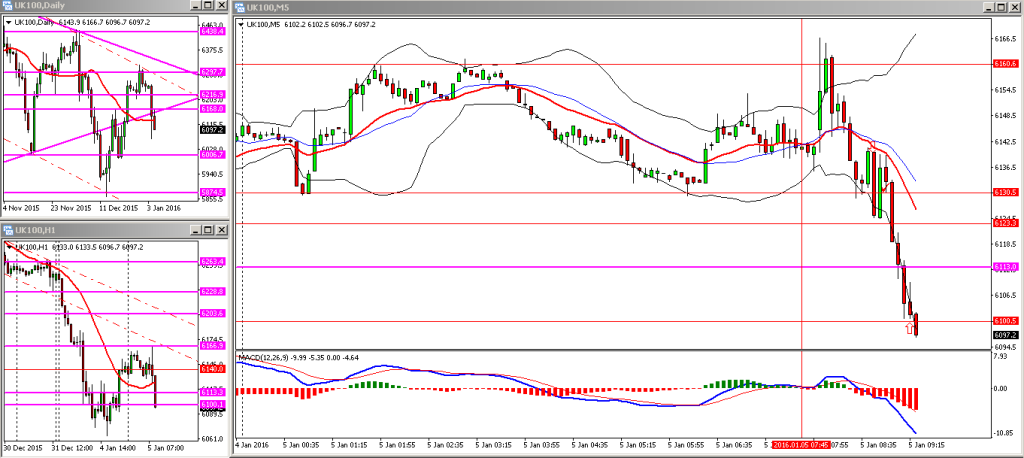

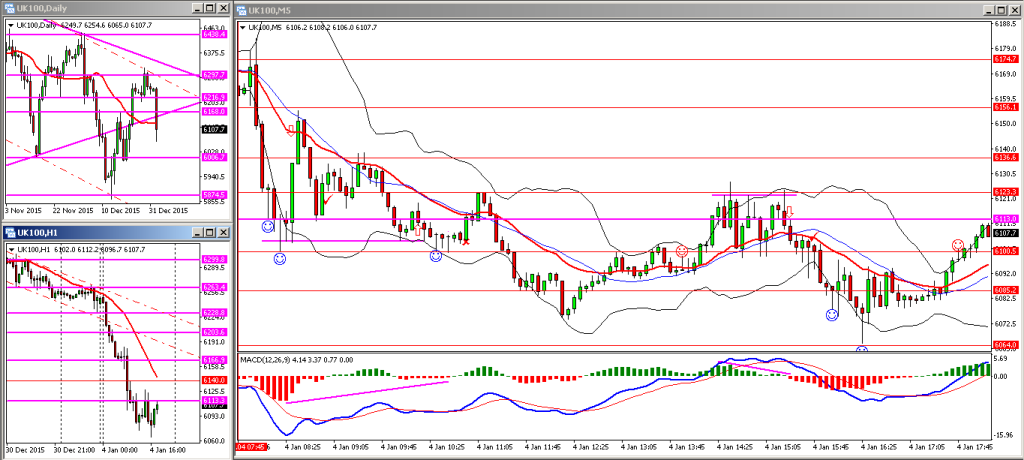

Over the three days that I traded (didn’t trade on the 31st as market was only open for half a day), my performance was average. I tried to keep in sync with the short-term trend although I did place a few counter-trend trades based on MACD divergences and key levels. I was quick to bank the points when they were available and in hindsight would have done well if I held some of the trades longer, especially when trading with the trend.

As the market turned and sold off I took my foot off the gas pedal as it were, with the expectation that the rally would resume into the last day of the week. I would have done well had I simply traded off what I saw on the chart, and held onto some of the shorts from the 6300 level. Looks like the market has handed me another lesson!