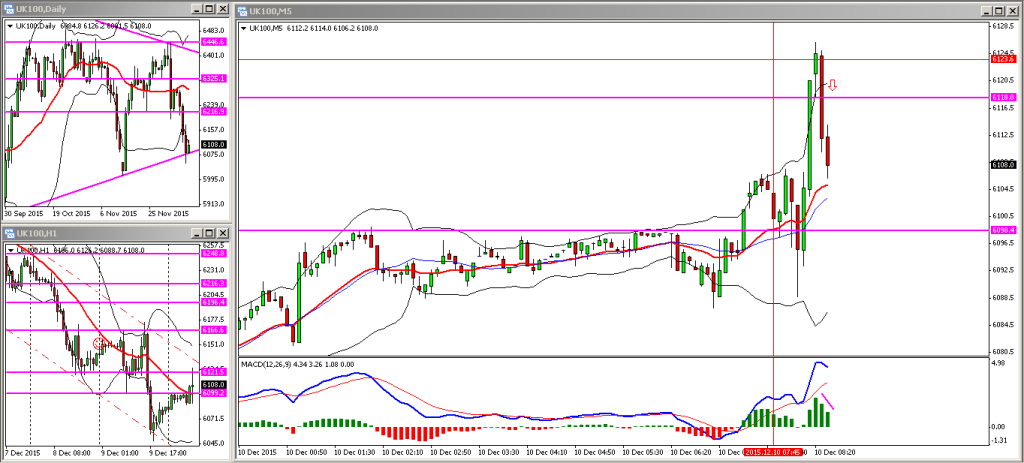

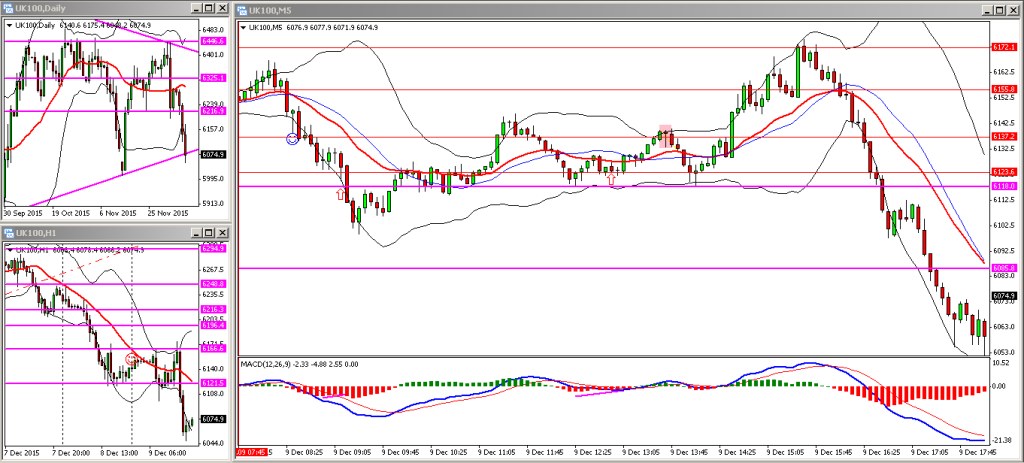

Key points to note going into this mornings session:

- On the daily chart the FTSE had broken through the lower trendline indicating a clear break in structure

- On the hourly chart the FTSE was at the top of the downward sloping channel

Given the factors above I was keen to short any pullbacks this morning…

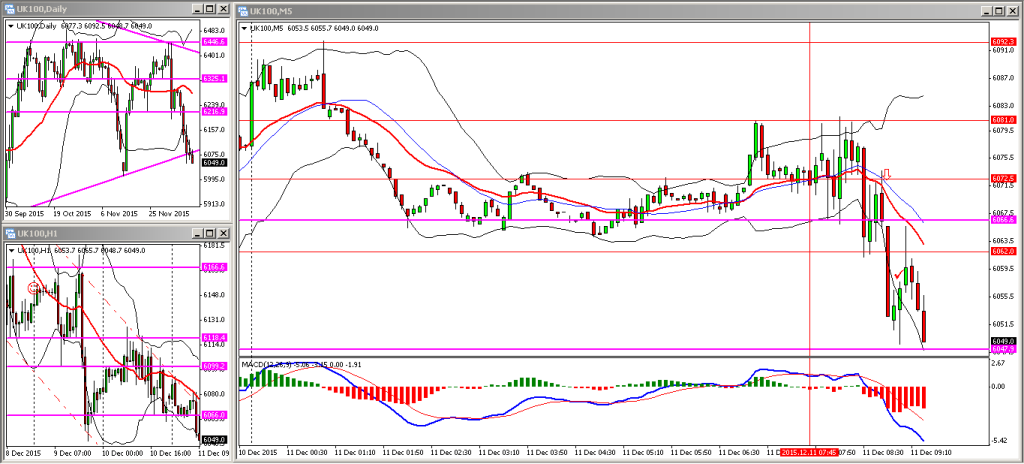

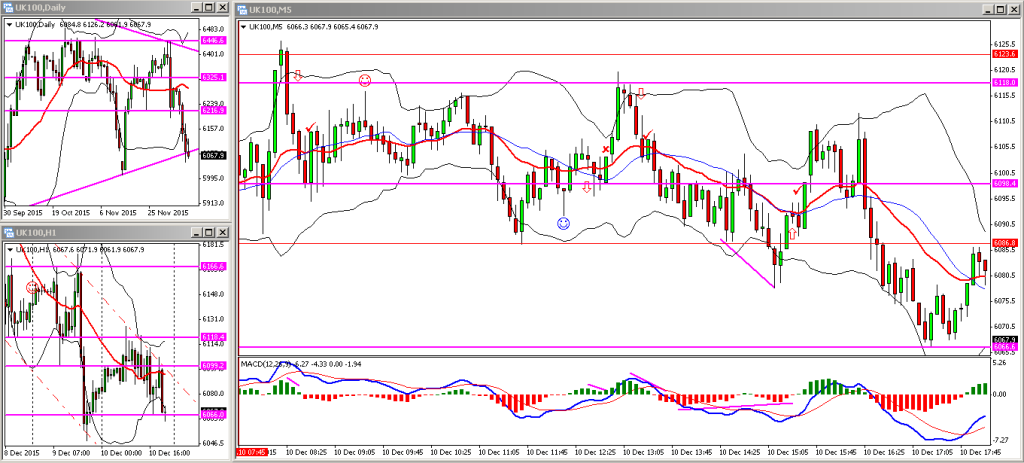

I went short at the overnight resistance level of 6072 which also coincided with a pullback to the 20EMA, trailed my stop as the market fell, then got stopped out as it pushed up. Points in the bank and a good trade to reflect on; may not trade at all for the rest of the day unless I see a cracking setup present itself.