My thoughts going into this morning are as follows:

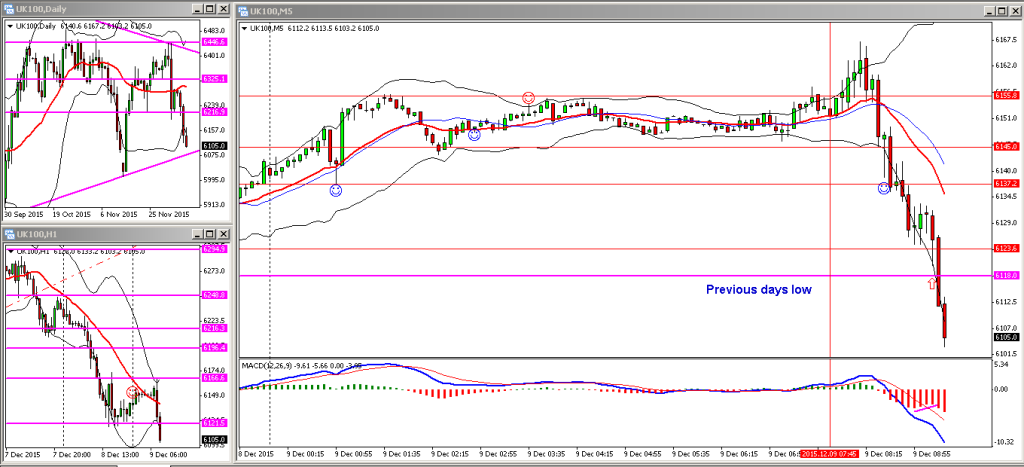

- Overnight the FTSE has been trading in a relatively narrow range between 6145 and 6155.

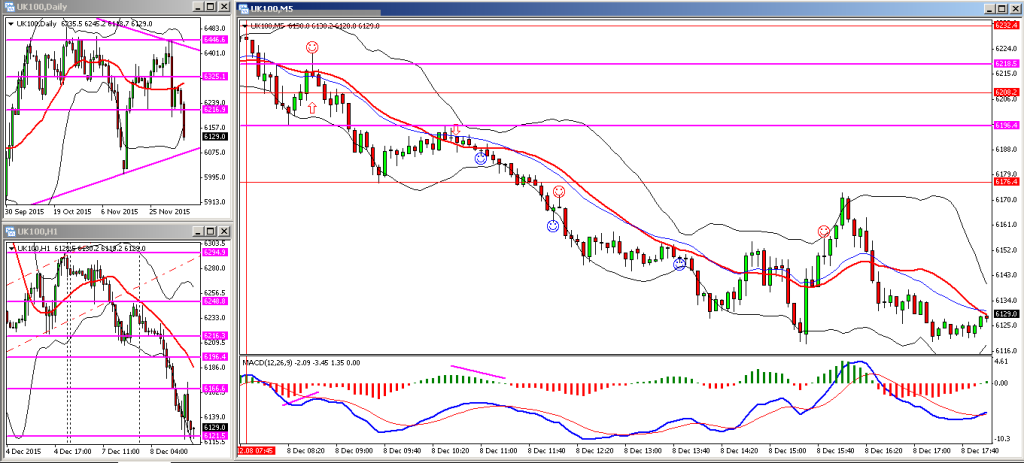

- The last two days have seen the market rally up and continue to sell off for the best part of the day, then recover during the US session, or after market hours.

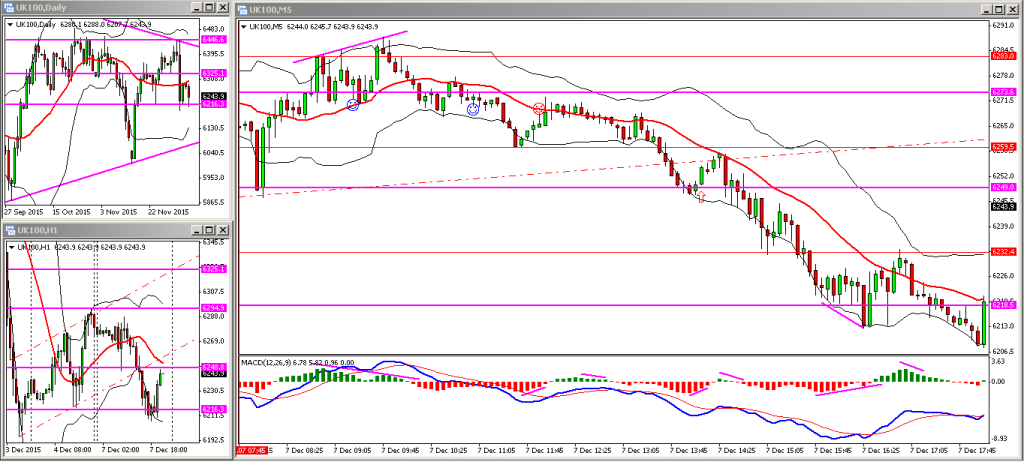

- On the daily chart the market is not far off the upward sloping trendline, a triangle pattern formation; so beware of a pullback off that trendline.

Although I was planning to short the market on any significant pullbacks, I was slow off the mark as the market seemed to sell off straight from the open, and I was unable to get on-board as intended.

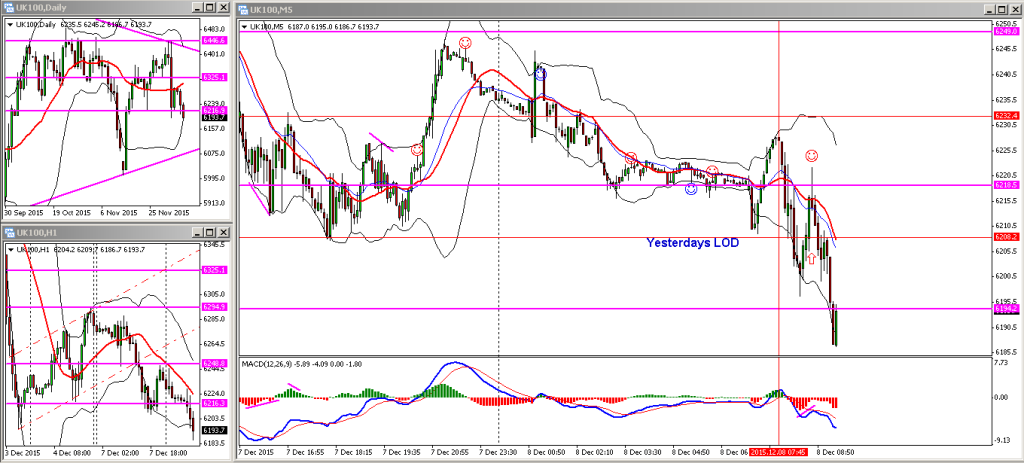

I have just taken a speculative long off the yesterdays low of the day (LOD) at 6118 (MACD histogram bars seemed to be declining) and looks like I’m going to get stopped out.

Note to self … Learn to trade with the trend you fool! Don’t try to catch falling knives!