It’s been a crazy week and as you may have noticed, I haven’t been able to trade throughout the week nor have I been able to post my usual commentary on the FTSE in the morning or the evenings …

I have had a lot going on in my personal and professional life, and have recently taken up a new opportunity based in Canary Wharf which means I will not be able to trade the FTSE during the day! I have a one and a half hour journey to work each way which has resulted in a longer working day; as well as the fact that I’ll be travelling daily by tube (underground) which means I have no access to the internet during the open.

However, I will still continue to trade but off longer time frame charts (weekly, daily and 4-hourly) using price action strategies (no indicators, no MACD, etc.) and will continue to post my thoughts on this blog. I’ve also decided it might be an appropriate time to widen my list of markets to include other indicies and foreign exchange markets which is something that I’ve traded in the past.

As for this weekend I’ll give you a quick analysis of the FTSE looking at the HTF chart:

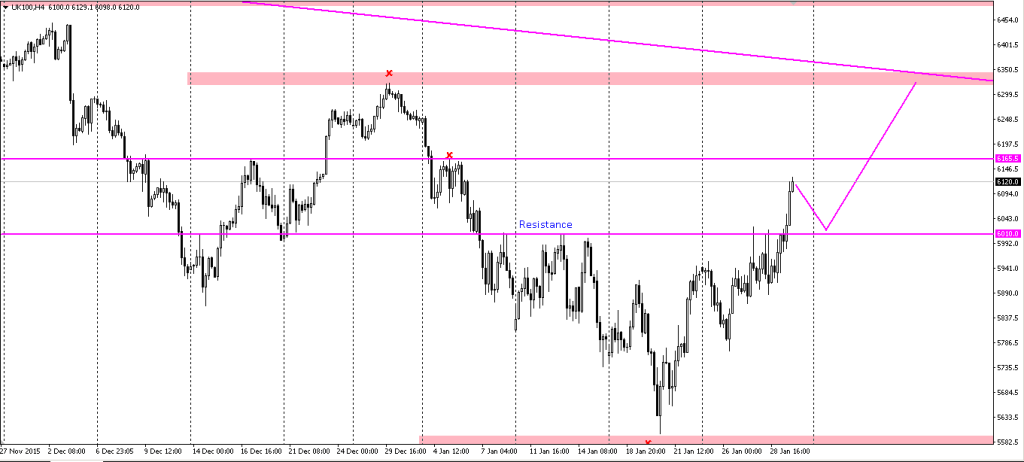

The FTSE resumed the upward move following the bounce we witnessed last week and posted a bullish looking hammer. I think 6235 will be a key level next week and will be looking to see if the FTSE can break through the downward sloping trendline shown on the chart, and possibly take out the stops indicated above (stops are located where you see the slim pink horizontal zones).

Looking at the 4H chart, the FTSE had formed a rather messy looking inverted head and (multiple) shoulders formation, before breaking beyond the 6000 level. I expect price to pullback to re-test the 6010 level as shown below, before resuming its upward momentum next week.