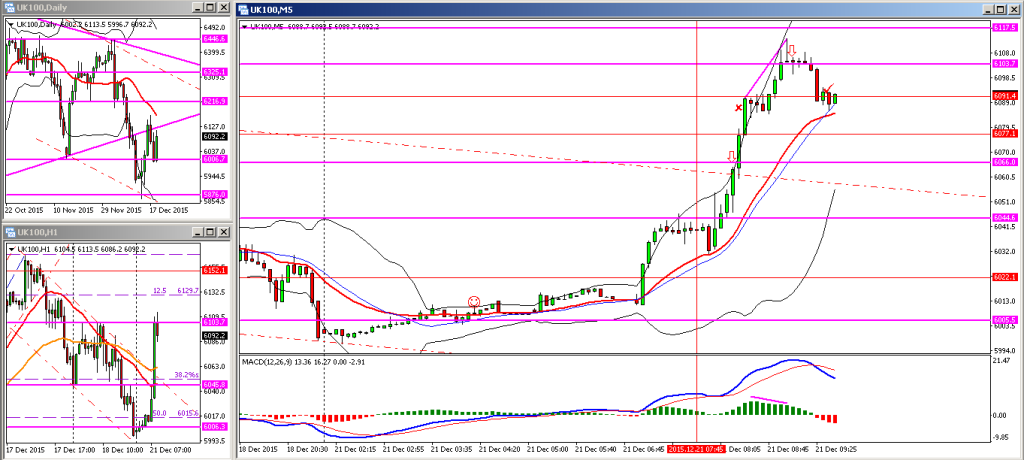

Overnight the market had been pretty flat and only proceeded to turn up during the pre-market session. Taken two trades this morning the first being a support / resistance play at the 6066 level with further confluence as price had also extended past the upper trendline on a downward sloping channel and just pulled back into it that channel – unfortunately it was stopped out 10 minutes later for 20 points. The second trade was a MACD divergence trade as price spiked up beyond the 6100 level, which I closed out for 15 points.

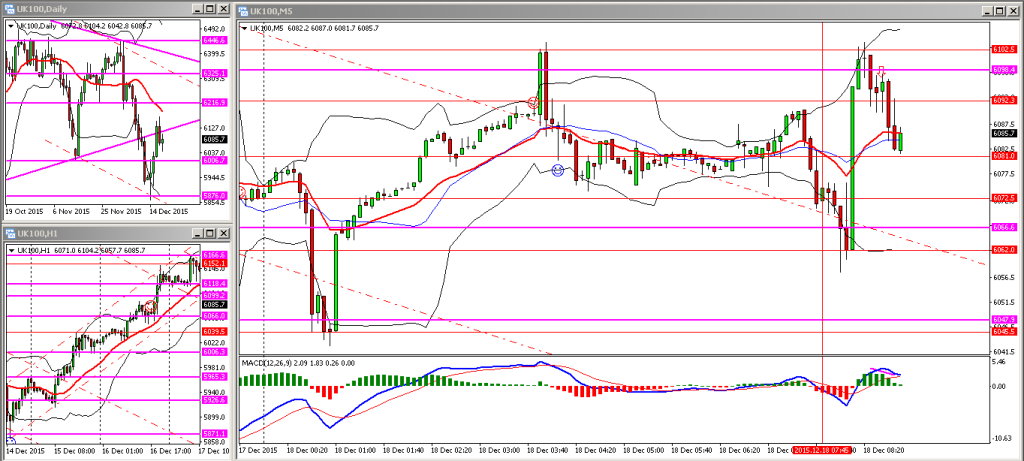

We saw the FTSE 100 index bounce off two levels overnight, support at 6045 and resistance at 6100. Pre-open the market had dropped back down to 6062 level and the plan of action was to short any pullbacks to key levels marked on my chart. The market raced up to the 6100 level immediately at the open and I waited till it seemed to running out of steam before getting in short with the MACD histogram bars shrinking, indicating a change in momentum.

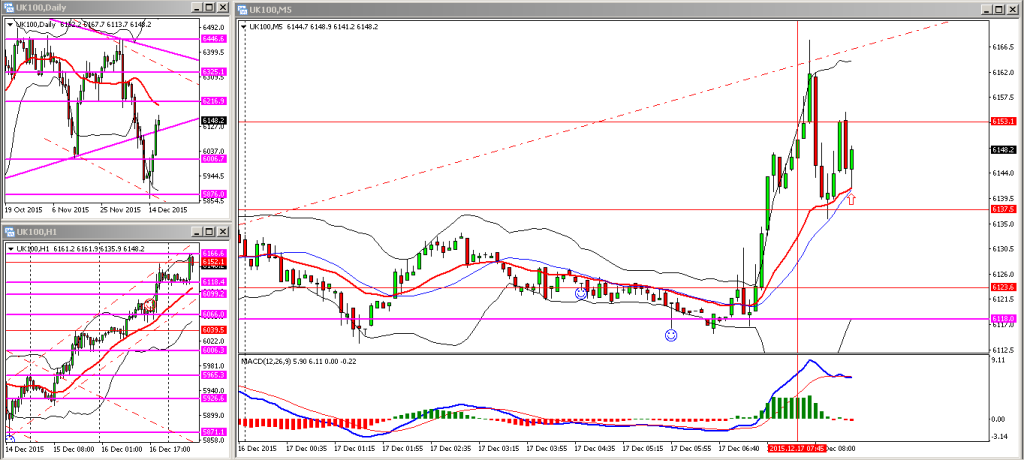

The FTSE stayed above the 6100 level overnight and moved up bullishly pre-open. I suspect that we could see further upside today and I’m quite happy to buy the dips today. I managed to get in at 6141 after price had bounced off a previous support / resistance level, and came back down to re-test the 20MA.

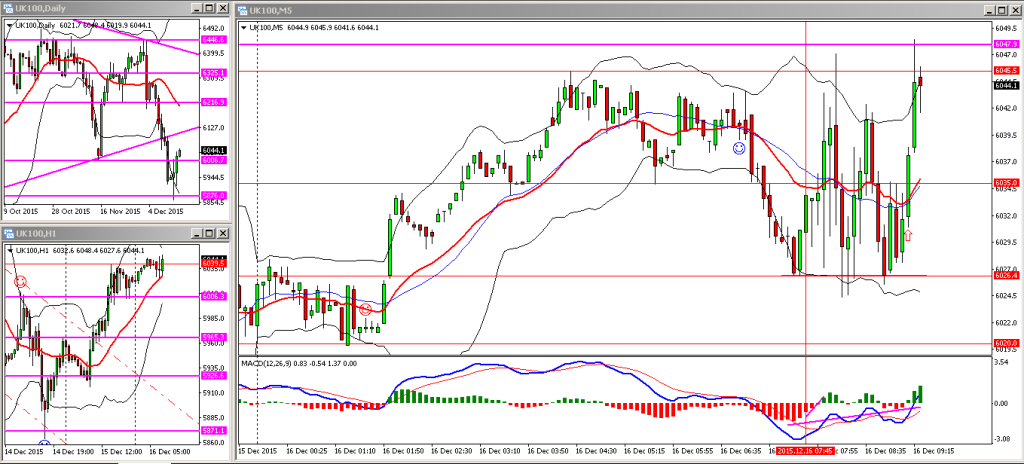

Going into this mornings session the following points were evident:

- The FTSE had finally posted a green candle on the daily chart after several consecutive red ones.

- There was a sell off after hours yesterday followed by a good recovery overnight so I was expecting some continuation this morning.

The open was a little messy with several long candles as you can see on the 5 minute chart, and the FTSE oscillating between the levels of support and resistance between the 6026 and the 6045 levels respectively.

In addition to the triple bottom formation, I also noticed a class-B divergence between price and the MACD histogram bars so I’ve taken a long @ 6030 with a 20 pip stop which I’ve already trailed in.