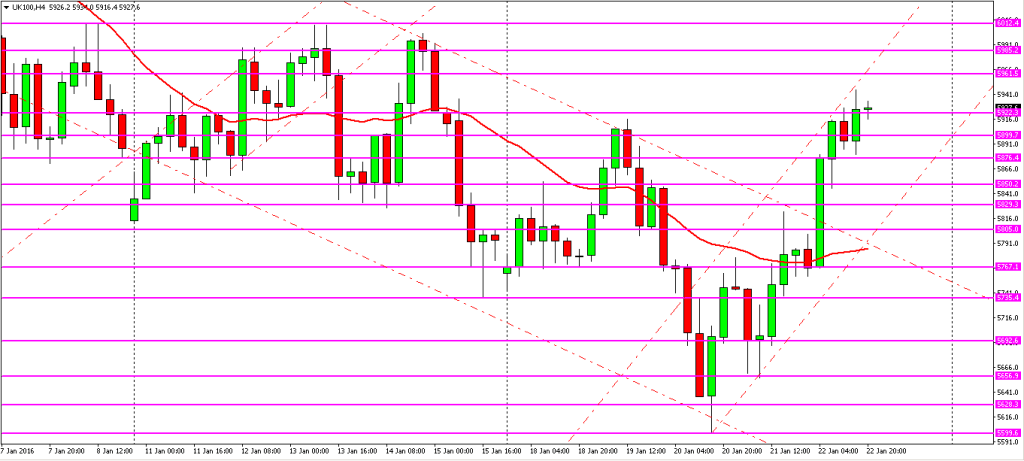

The FTSE started off the week positively and pushed up from the 5800 level, it got up as high as 5900 before changing direction on Tuesday, fell heavily down to the 5600 level by Wednesday afternoon, from where it rebounded to finish up above the 5900 level again by the end of the week. So in summary we had both the bulls and bears satisfied to some degree this week with the market oscillating in within a 300 point range.

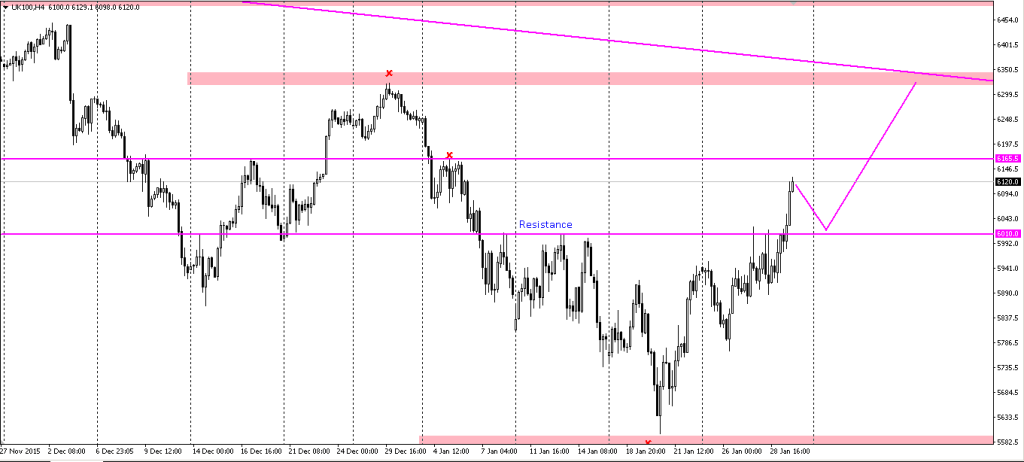

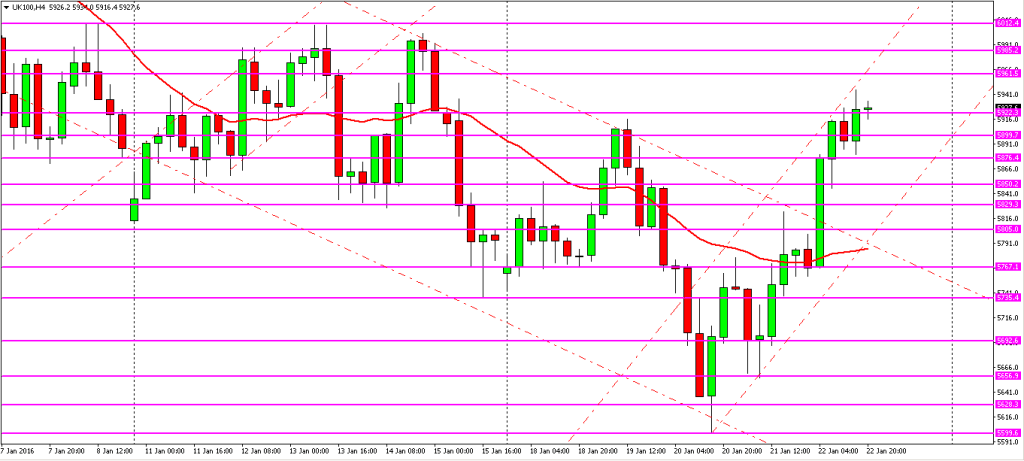

The 4H chart of the FTSE is shown below, clearly indicating a sharp fall followed by the breakout from the downward channel that the FTSE had been moving in for the last few weeks. It’ll be interesting to see if we can push on up above the 6000 level once again.

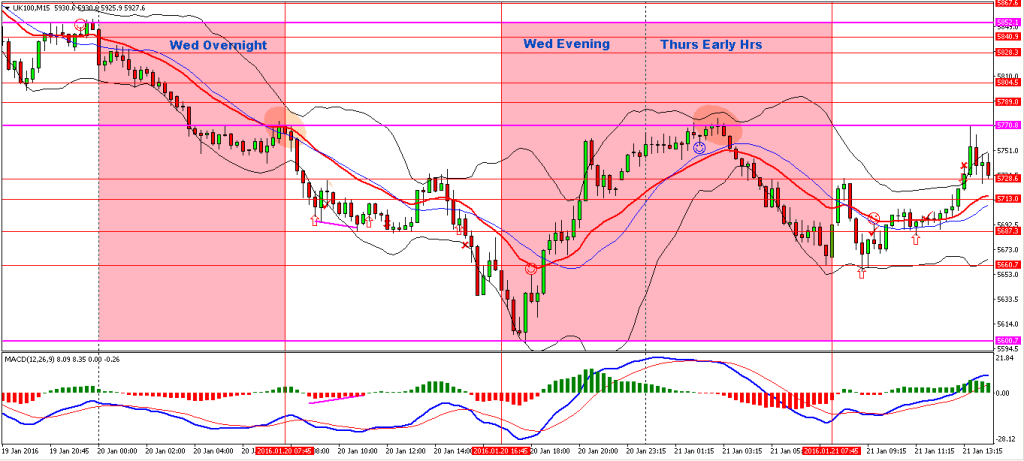

My personal performance was far from ‘optimal’ and I found myself chasing the market to some extent. The larger moves last week happened out of hours (due to FTSE futures reacting to the Asian markets) and I found that I was placing counter-trend trades as a result, anticipating the ‘air’ to fill. In future, I think I have to consider placing trades outside of market hours if price happens to reach key support and resistance levels.

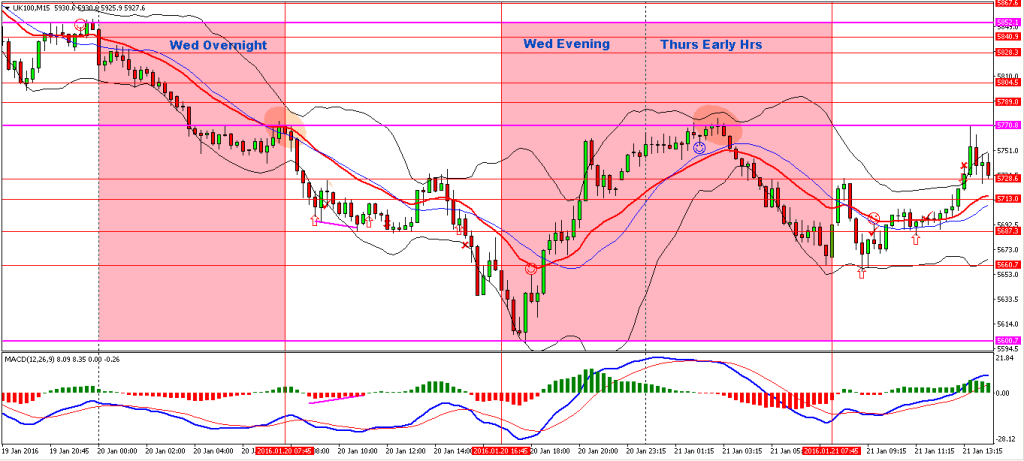

The chart below shows the large moves that occurred on Wednesday early hours (before markets opened) and in the evening (once markets closed), and then again on Thursday in the early hours. I’m kicking myself for not trading the 5770 level, although on Wednesday the market tanked straight off the open and it would have been hard to catch that. Also missed out on the 5600 level, the weekly low which was hit on Wednesday after hours.

Unfortunately, there were some of the same old habits creeping in such as trading against the trend, mis-timing certain trades which went in the direction anticipated after stopping me out, as well as closing out winners too soon and not cutting loses early enough. Will have to keep working on my game …